Guardians of the Vault: The Unsung Role of Encryption in Payment Gateways

Dec 12, 2024 - 2 MINS READ

The convenience of online shopping is undeniable. With a few clicks, you can purchase anything from groceries to gadgets, delivered right to your doorstep. But have you ever stopped to wonder how your sensitive financial information stays secure during these transactions? The answer lies in a powerful technology often working behind the scenes: encryption.

Demystifying Encryption:

Imagine a secret code that scrambles data into an unreadable format. This is essentially what encryption does. It transforms sensitive information like credit card numbers and bank account details into an unintelligible cipher, accessible only with a special key. This key acts like a digital password, allowing authorized parties to decrypt the data and complete the transaction.

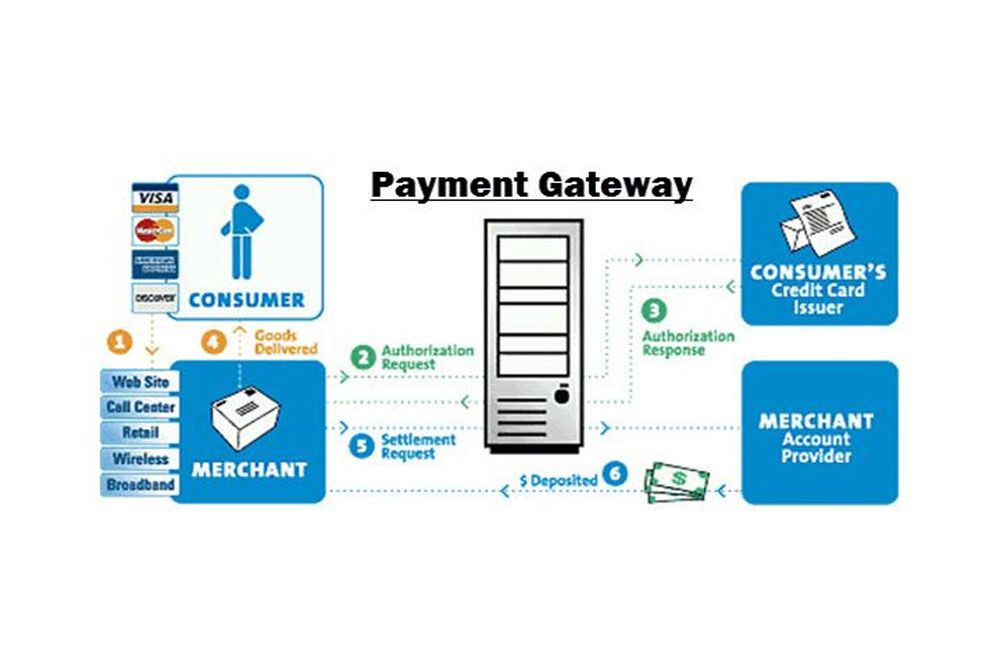

Encryption in Action: The Payment Gateway Journey

When you enter your payment details on an e-commerce platform, the information is intercepted by the payment gateway. Here's where encryption takes center stage:

-

Data Encryption: The gateway utilizes robust encryption algorithms to scramble your sensitive data. This could involve industry-standard algorithms like AES (Advanced Encryption Standard) or RSA (Rivest–Shamir–Adleman).

-

Secure Transmission: The encrypted data is then securely transmitted to the payment processor, the bank that verifies and authorizes the transaction. This secure transmission often utilizes protocols like TLS (Transport Layer Security), ensuring data integrity and preventing interception by unauthorized parties.

-

Authorization and Processing: The payment processor, equipped with the decryption key, unlocks the encrypted data and verifies the transaction details with your bank. Once authorized, the payment is processed.

-

Data Storage: Even after the transaction is complete, some payment gateways might store encrypted data for record-keeping purposes. However, stringent regulations like PCI DSS (Payment Card Industry Data Security Standard) mandate robust security measures for data storage, minimizing the risk of breaches.

The Benefits of Encryption:

-

Enhanced Security: Encryption significantly reduces the risk of data breaches. Even if hackers intercept encrypted data, it remains unreadable without the decryption key, safeguarding your financial information.

-

Building Customer Trust: Customers prioritize secure transactions. By implementing robust encryption, payment gateways foster trust and confidence, encouraging customers to embrace online shopping.

-

Compliance with Regulations: PCI DSS and other regulations mandate secure data handling practices. Encryption plays a crucial role in ensuring compliance and protecting customer data.

The Future of Encryption in Payment Gateways:

As technology advances, so too will encryption methods. We can expect to see:

-

Quantum-resistant Encryption: As quantum computing evolves, existing encryption algorithms might become vulnerable. The development of quantum-resistant encryption will be crucial to safeguard data in the future.

-

Homomorphic Encryption: This emerging technology allows computations to be performed on encrypted data without decryption. This could revolutionize online transactions while maintaining data privacy.