Understanding the Payment Gateway Process: Authorization and Settlement

Sep 28, 2024 - 2 MINS READ

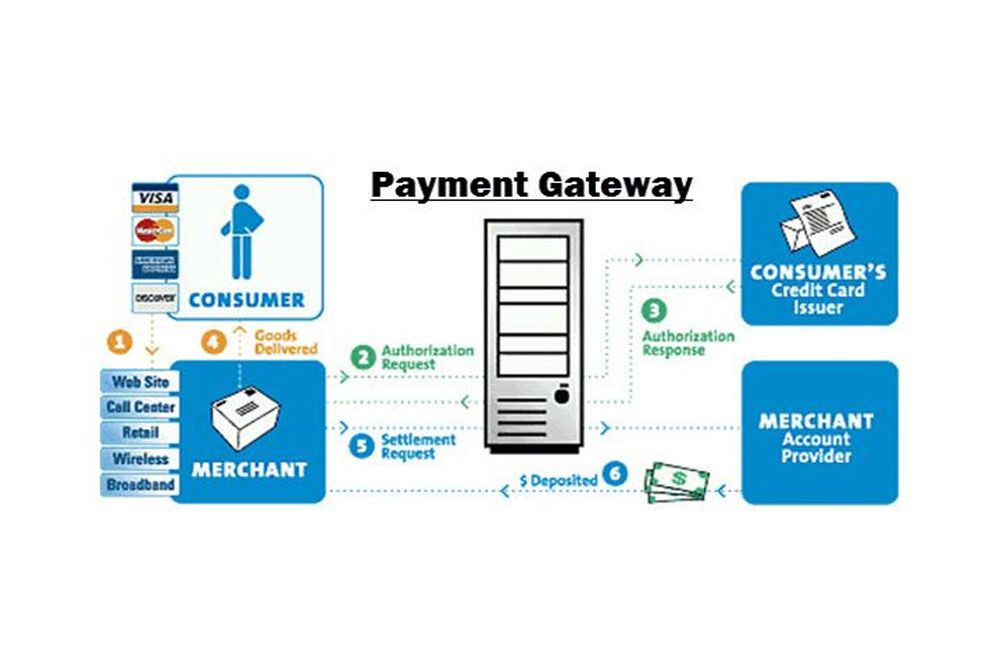

When you make a purchase online, the seamless experience often masks the complex processes happening behind the scenes. Central to this is the payment gateway, a crucial component that facilitates secure transactions between you, the merchant, and your bank. This blog delves into the two primary stages of this process: authorization and settlement.

Authorization: The Green Light

Authorization is the initial phase of a transaction, akin to a pre-approval. Here's a breakdown of the process:

-

Initiation: When you complete a purchase, the merchant's payment gateway sends a request to the acquiring bank (the merchant's bank).

-

Verification: The acquiring bank forwards the request to the issuing bank (your bank) for verification. The issuing bank checks if your card is valid, has sufficient funds (for debit cards), or available credit (for credit cards).

-

Authorization Response: The issuing bank sends a response to the acquiring bank, which is then relayed to the merchant's payment gateway. This response indicates whether the transaction is approved or declined.

If approved, a temporary hold is placed on the funds in your account, ensuring the merchant can claim the funds later. This hold is usually released within a few days if the transaction is not completed.

Settlement: The Final Step

Settlement is the process of transferring funds from the customer's account to the merchant's account:

-

Capture Request: After the goods or services have been delivered, or a specific period has elapsed (usually a few days), the merchant initiates a capture request to the payment gateway.

-

Funds Transfer: The payment gateway transfers the authorized funds from the issuing bank to the merchant's acquiring bank.

-

Deposit to Merchant Account: The acquiring bank deposits the funds into the merchant's account, usually within a few business days. This is when the merchant finally receives the payment for the goods or services provided.

Factors Affecting Authorization and Settlement

Several factors can influence the authorization and settlement process:

-

Transaction Amount: Larger transactions might undergo additional security checks, potentially delaying authorization.

-

Card Type: Debit cards typically have stricter authorization rules compared to credit cards.

-

Customer History: Customers with a history of fraudulent transactions might face stricter authorization requirements.

-

Network Congestion: Technical issues or high transaction volumes can cause delays in authorization and settlement.

Understanding the Process Benefits You

Understanding the authorization and settlement process empowers you as a consumer:

-

Dispute Resolution: Knowing the process helps you understand the steps involved in case of a dispute.

-

Faster Refunds: Understanding the settlement process can expedite refunds if you need to return a product.

-

Security Awareness: Awareness of the security measures involved in payment processing can help you protect your financial information.