Top Benefits of Using a Payment Gateway for Your Business: Streamlining Transactions and Boosting Sales

Jul 01, 2024 - 2 MINS READ

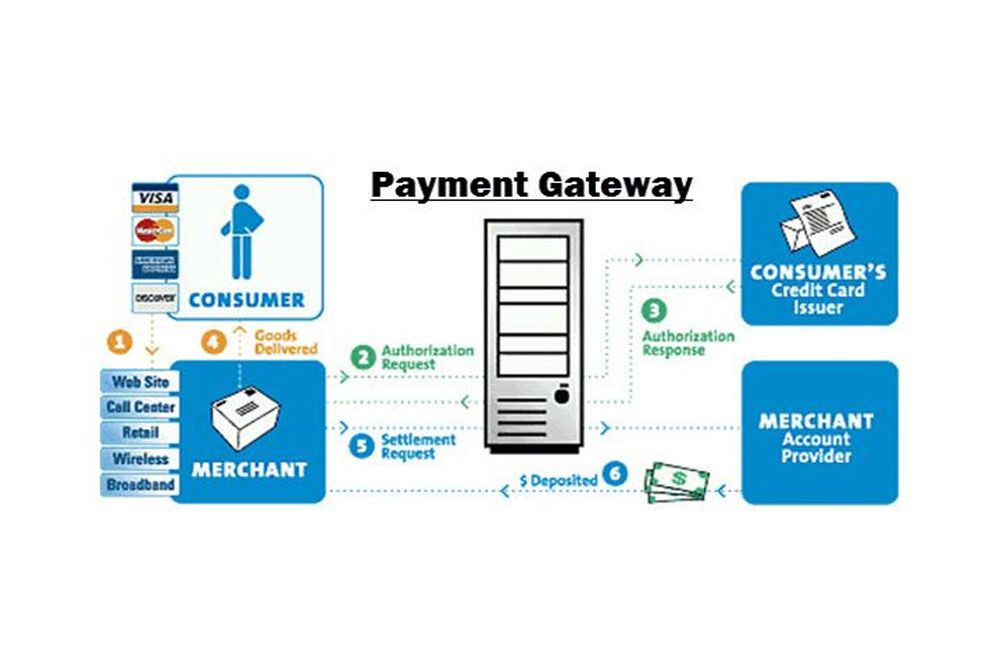

In today's digital landscape, customers expect a smooth and secure online shopping experience. A clunky checkout process riddled with friction can lead to cart abandonment and lost sales. This is where payment gateways come in. They act as secure bridges between your online store and various payment processors, empowering you to accept a wide range of payment methods and streamline your transaction flow. Let's delve into the top benefits of using a payment gateway for your business:

Enhanced Security: Building Trust Through Secure Transactions

Payment gateways prioritize the safety of your business and your customers:

-

Encryption Technology: Payment gateways utilize advanced encryption technology to safeguard sensitive financial data during transactions. This protects your customers' credit card information and reduces the risk of fraud for your business.

-

Compliance Standards: Payment gateways adhere to stringent security protocols and industry-standard compliance regulations. This ensures your business operates within regulatory frameworks and fosters trust with your customers.

-

Fraud Prevention Tools: Many payment gateways offer built-in fraud prevention tools that analyze transactions for suspicious activity. This helps mitigate the risk of fraudulent purchases and protects your business from financial losses.

Convenience at Its Finest: A Streamlined Checkout Experience

Payment gateways simplify the checkout process for both you and your customers:

-

Multiple Payment Options: Payment gateways allow you to accept a variety of payment methods, including credit cards, debit cards, e-wallets, and even alternative payment solutions. This caters to diverse customer preferences and eliminates the barrier of limited payment options.

-

Faster Checkouts: Payment gateways streamline the checkout process by securely processing transactions in real-time. This eliminates manual verification steps and ensures a quicker checkout experience for your customers, reducing cart abandonment rates.

-

Mobile-Friendly Payments: With the rise of mobile commerce, payment gateways enable secure mobile payments. Customers can conveniently make purchases using their smartphones or tablets, catering to the growing trend of on-the-go shopping.

Operational Efficiency: Simplified Management and Reduced Costs

Payment gateways offer operational benefits that empower your business:

-

Centralized Management: Payment gateways provide a centralized platform for managing all your online transactions. This simplifies reconciliation, record-keeping, and overall financial management.

-

Reduced Administrative Burden: By automating many aspects of the payment process, payment gateways reduce the administrative burden on your staff. This frees them up to focus on other crucial business areas.

-

Potential Cost Savings: Payment gateways can offer competitive transaction fees compared to traditional merchant accounts. Additionally, streamlining your operations can lead to overall cost savings.

Scalability and Growth: Expanding Your Reach with Flexibility

Payment gateways empower your business to grow and scale:

-

Flexible Integrations: Payment gateways seamlessly integrate with various shopping carts and e-commerce platforms. This flexibility allows you to choose the solutions that best suit your business needs and adapt to future growth.

-

Global Reach: Many payment gateways offer support for international transactions and multiple currencies. This allows you to expand your customer base and reach new markets without geographical limitations.

-

Data and Analytics: Payment gateways can provide valuable data and analytics on your transactions. This allows you to gain insights into customer behavior, identify buying trends, and make informed decisions to optimize your sales strategies.

The Future of Payment Gateways: Evolving with Innovation

The world of payment processing is constantly evolving:

-

Emerging Technologies: The future might see payment gateways integrate with emerging technologies like blockchain or cryptocurrency. This could potentially revolutionize online payment security and efficiency.

-

AI-Powered Fraud Detection: Future iterations of payment gateways might utilize artificial intelligence for even more sophisticated fraud detection capabilities. This would further enhance security and protect businesses from evolving fraudulent activities.

-

Frictionless Payment Experiences: The future could see a move towards frictionless payment experiences. Biometric authentication or one-click checkout options could become commonplace, further simplifying the online shopping journey.

Conclusion: The Power of Seamless Transactions

In today's competitive online marketplace, a seamless and secure checkout experience is no longer a luxury, it's a necessity. Payment gateways offer a multitude of benefits that go beyond simply processing payments. They enhance security, streamline operations, and empower your business to grow and scale. By implementing a reliable payment gateway, you can create a frictionless checkout experience that fosters customer trust, boosts sales, and propels your business towards continued success. So, explore the options