The Role of Payment Gateways in Facilitating Instant Loans

Jul 20, 2024 - 2 MINS READ

Introduction

The lending industry has undergone a significant transformation in recent years, with the emergence of instant loans becoming increasingly commonplace. At the heart of this revolution lies the payment gateway, a technology that has played a pivotal role in enabling quick and seamless loan disbursements. This blog explores the crucial role of payment gateways in facilitating instant loans and the benefits they bring to both lenders and borrowers.

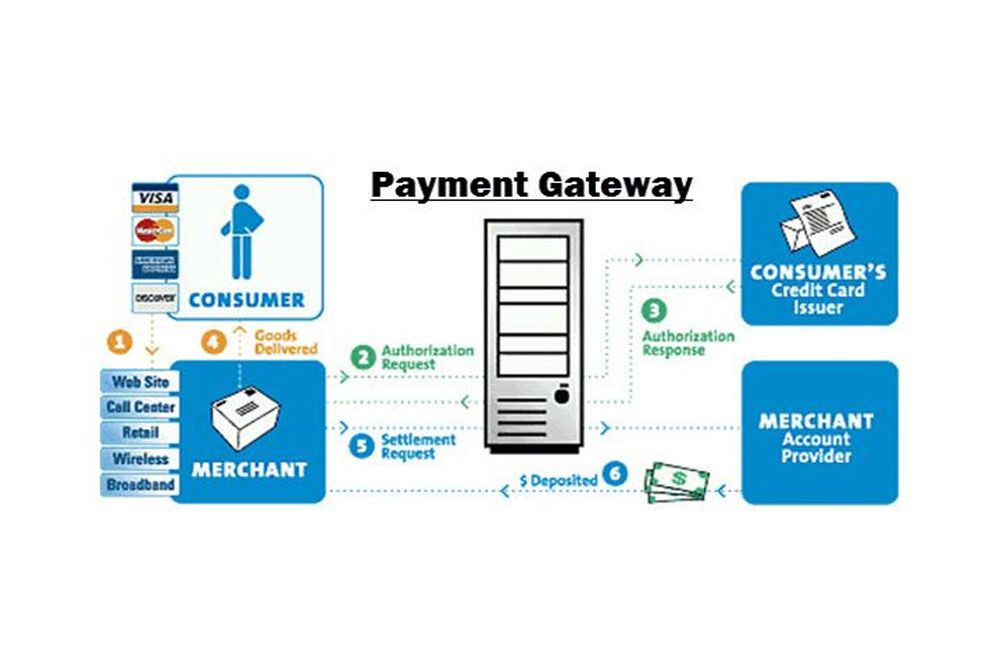

Understanding Payment Gateways

A payment gateway is a digital platform that enables online and mobile transactions. It acts as a secure intermediary between a merchant (in this case, the lender) and the customer (the borrower). When a loan is approved, the payment gateway facilitates the transfer of funds from the lender's account to the borrower's account in real-time.

Key Role of Payment Gateways in Instant Loans

-

Real-time Fund Transfer: Payment gateways are equipped to process transactions swiftly, ensuring that loan funds are disbursed to borrowers immediately upon approval. This eliminates the delays associated with traditional loan disbursement methods.

-

Enhanced Security: Robust encryption and fraud prevention measures implemented by payment gateways safeguard sensitive financial information, protecting both lenders and borrowers from fraudulent activities.

-

Seamless Integration: Payment gateways can be seamlessly integrated into lending platforms, providing a smooth user experience for borrowers. The entire loan application and disbursement process can be completed without any interruptions.

-

Multiple Payment Options: Payment gateways support a variety of payment methods, allowing borrowers to choose the most convenient option for them. This flexibility enhances customer satisfaction.

-

Data Analytics: Payment gateways collect valuable data on transaction patterns, which can be utilized by lenders to assess borrower risk and improve underwriting processes.

Benefits of Instant Loans Facilitated by Payment Gateways

-

Improved Customer Experience: Borrowers benefit from a quick and hassle-free loan application and disbursement process. This convenience enhances customer satisfaction and loyalty.

-

Financial Inclusion: Instant loans can help bridge the financial gap for individuals who may not have access to traditional credit sources. Payment gateways play a crucial role in making these loans accessible to a wider population.

-

Increased Efficiency: By automating the loan disbursement process, payment gateways help lenders streamline operations and reduce processing time.

-

Risk Mitigation: Real-time transaction monitoring and fraud prevention features of payment gateways help lenders mitigate risks associated with loan defaults.