Safeguarding Your Transactions: A Guide to Security Measures in Payment Gateways

Jul 25, 2024 - 2 MINS READ

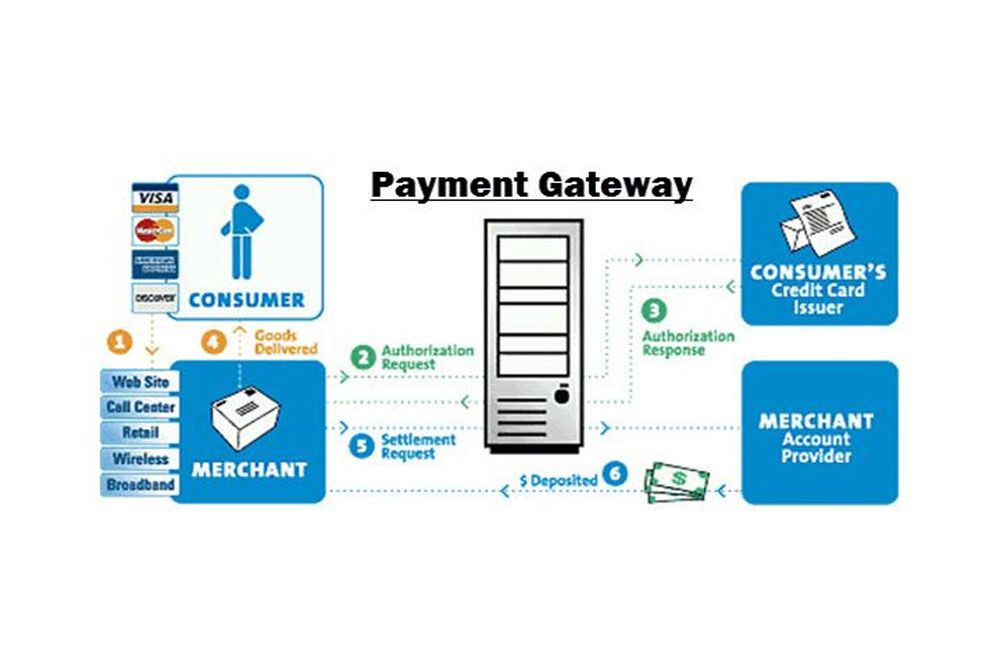

In today's digital age, online shopping reigns supreme. But with convenience comes the crucial question: how secure are my transactions? Payment gateways, the invisible facilitators of online payments, play a vital role in safeguarding your financial information. This blog demystifies the security measures employed by payment gateways, empowering you to shop online with confidence:

Building the Fortress: Encryption as the Foundation of Security

Payment gateways prioritize the security of your financial data:

-

Encryption Technology: Payment gateways utilize robust encryption technology to scramble sensitive information like credit card numbers during transmission. This makes it virtually impossible for unauthorized individuals to intercept and decipher your data. Think of it as a secret code that only authorized parties can understand.

-

Secure Sockets Layer (SSL) and Transport Layer Security (TLS): These encryption protocols form the backbone of secure online communication. Payment gateways implement SSL/TLS to create a secure tunnel between your browser and the gateway server, ensuring your data remains confidential throughout the transaction process.

Beyond Encryption: Compliance and Additional Security Layers

Security goes beyond just encryption:

-

PCI DSS Compliance: Payment gateways adhere to the Payment Card Industry Data Security Standard (PCI DSS). This rigorous set of regulations mandates stringent security measures for handling cardholder data. By partnering with a PCI DSS compliant gateway, you can be assured that your information is protected according to industry best practices.

-

Fraud Detection and Prevention: Payment gateways employ sophisticated fraud detection systems that analyze transactions for suspicious activity. These systems utilize algorithms and machine learning to identify potential fraud attempts, safeguarding you from unauthorized charges.

-

Authentication Protocols: Many payment gateways implement additional authentication protocols like 3D Secure (3DS). This adds an extra layer of security by requiring customers to verify their identity with a one-time password or fingerprint scan before completing a transaction.

Tokenization: A Shield for Sensitive Information

Tokenization adds another layer of security:

-

Replacing Sensitive Data: Tokenization replaces your actual credit card number with a unique token (a random string of characters) during transactions. The merchant only receives the token, not your actual card details. Even if a data breach occurs, hackers would only steal these meaningless tokens, rendering your real credit card information safe.

Risk Management: A Proactive Approach to Security

Payment gateways take a proactive approach to risk management:

-

Risk-Based Authentication: This approach analyzes the risk level of a transaction based on various factors like purchase amount, location, and customer history. Low-risk transactions might require minimal verification, while high-risk transactions might trigger additional authentication steps. This ensures a balance between security and a smooth checkout experience.

-

Regular Security Audits: Payment gateways undergo regular security audits by independent security professionals. These audits identify potential vulnerabilities and ensure the gateway's security measures remain robust and up-to-date.

Your Role in Secure Transactions: Maintaining Vigilance

While payment gateways prioritize security, vigilance is a two-way street:

-

Beware of Phishing Attempts: Be cautious of emails or websites mimicking legitimate businesses. Always double-check the URL before entering any sensitive information.

-

Strong Passwords and Multi-Factor Authentication: Use strong passwords for your online accounts and enable multi-factor authentication whenever possible. This adds an extra layer of security by requiring a second verification step beyond just your password.

-

Review Bank Statements Regularly: Monitor your bank statements regularly for any unauthorized charges. If you suspect fraudulent activity, immediately report it to your bank and the payment gateway you used.

Conclusion: Peace of Mind Through Secure Transactions

Understanding the security measures employed by payment gateways empowers you to shop online with confidence. Encryption, compliance, fraud detection, and tokenization all work together to create a secure environment for your transactions. By staying vigilant and partnering with reputable payment gateways, you can enjoy the convenience of online shopping while safeguarding your financial information. So, the next time you make an online purchase, remember the silent heroes ensuring your transactions are secure and protected.