META coming into Fintech World

Mar 04, 2022 - 6 MINS READ

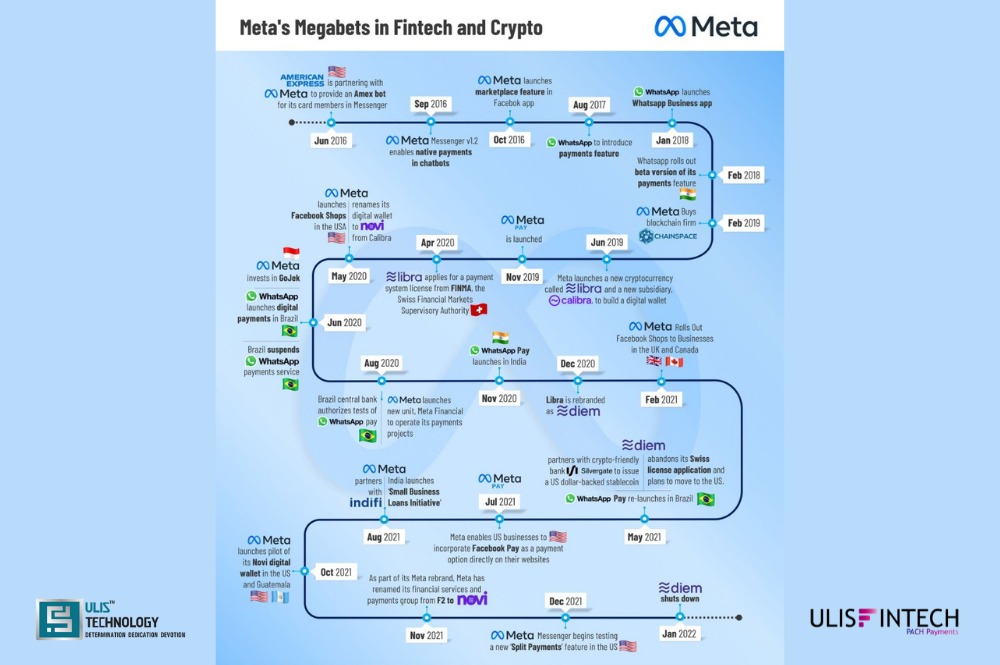

Meta coming into the Fintech world

Meta intends to roll out Novi Wallet, its new mobile payments solution, across all of its subsidiary firms, including Facebook, WhatsApp, and Instagram. The recent renaming of Facebook to Meta—in order to underscore the platform's metaverse vision—has gotten a lot of press. The platform, on the other hand, is no stranger to examination.

The move comes as the social media behemoth continues an aggressive rebranding drive and expands into financial services, with a special emphasis on virtual reality and fintech.

Novi is a digital currency wallet that was released in October 2021 to store stable coins such as the Paxos Dollar (USDP). Users may use their cell phones to make purchases and transfer money more quickly and effectively. Customers have long sought a quick and simple way to convert fiat currency such as dollars and euros into cryptocurrencies. Stable coins, which are tied to real-world assets such as dollars and euros, have long been a popular way for clients to transition from fiat money to cryptocurrency.

David Marcus, the co-founder, and CEO of Novi stated in a recent tweet, With the acquisition of Facebook by Meta, we are combining our payments and financial services unit and products under the Novi name.

In the Latin language, the term "Novi" means "New" or "Accept." This translation appears to be a great match for what the social media behemoth is attempting to do in terms of creating a 'new' wallet to make and 'accept' payments.

Facebook has been actively extending its Messenger chat software with features such as peer-to-peer payments since 2019. It now wants to ensure that all of its financial technology activities are coordinated. Diversifying has always been a key component of the IT giant's innovation strategy, and adding payment services to its portfolio has long been a goal.

Via 2016, Meta partnered with American Express to give the bank's cardholders with an AmEx bot in the Messenger app, which was one of the company's first forays into the banking business.

Ingenious risk management

Building subsidiaries and changing brands are frequently connected with risk reduction since they reduce accountability to the related firms while generating confusion. It is also used by large firms to avoid monopoly-related disputes.

Another major digital business to reorganize in recent years was Google, which renamed its parent company Alphabet. While Facebook's decision is expected to be highly received by its compliance department, it is unclear if the new name will be a problem for users or regulators.

U.S. legislators Richard Blumenthal, Brian Schatz, Sherrod Brown, Tina Smith, and Elizabeth Warren have chastised Mark Zuckerberg for his incapacity to manage a payment system or digital money. It's impossible to trust Facebook to run a payment system or digital currency when its current risk management and consumer protection capabilities have shown to be woefully insufficient. Rebranding does not work, according to UK Digital, Culture, Media, and Sports Minister Nadine Dorries. "We will not remain silent while damage is done."

But that hasn't stopped the tech juggernaut from being one of the world's most valuable firms by market capitalization. Nonetheless, the Novi platform may be argued to provide sophisticated Know Your Customer (KYC) checks. It also includes features such as two-factor authentication and manual investigations to secure personal information and prevent fraud.

Due to the company's previous misuse of user data and refusal to pay proper taxes in the countries where it conducts business, it looks that any brand associated with Facebook may face challenges in the future. The Novi Wallet, on the other hand, was created with the goal of making fintech goods and services more accessible to users than ever before. Overall, it's difficult to predict how Novi or even Meta will do in the future; only time will tell.