Difference Between Payment Gateway And Payment Aggregator

May 03, 2021 - 8 MINS READ

Payment Gateway & Payment Aggregator

A payment gateway is software that allows online transactions to take place, while a payment aggregator is the inclusion of all these payment gateways. It is vital to know what is different and also similar between the two.

As a layman, one may know what an online payment gateway does; it makes the online payments transfer possible from one party to another. However, precisely there are two terms related to this function i.e. payment gateway and payment aggregator. Many would get puzzled between these two. There are many payment gateways as well as payment aggregators.

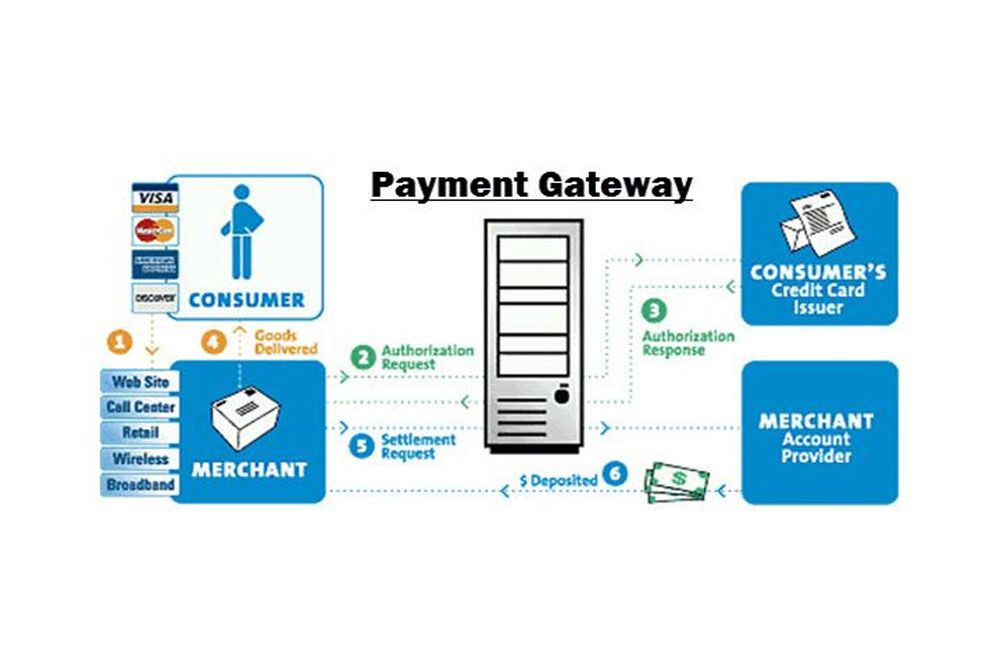

What is a Payment Gateway?

A Payment Gateway is an e-commerce software application, a software that allows online transactions to take place. It is a pass-through mechanism through which cards, net banking and e-wallet payments are done. Payment gateways offer a means to accept online payments.

What is a Payment Aggregator?

Payment Aggregator is the inclusion of all these payment gateways. Payment aggregators are service providers through which e-commerce merchants process payments. They allow merchants to accept bank transfers without setting up a merchant account that is associated with a bank.

In simple words, Payment Aggregator is a collection of Payment Gateways.

With payment gateway aggregators, one merchant account is used to represent a number of merchants opposed to the traditional model which disburses a merchant account to each merchant.

Both payment gateways and payment aggregators are comprehensive. A payment aggregator need not act as a payment gateway, but a payment gateway will need an aggregator.

The role between the parties

Payment Gateways acts as an intermediate between the merchants and customers whereas a payment aggregator is more like a facility with many such mediums connected with it and through which the intermediaries accept the funds and make settlements.

Intermediary & Interface

Payment Gateways play the role of an intermediary with merchants and customers who want to pay for any goods or services they are purchasing from the site. A payment aggregator is more an interface through which said intermediaries accept payments and make settlements.

Security and Compliances

Payment gateways are approved and licensed through the RBI authorization under the Payment and Settlement Systems Act, 2007 (PSSA). The payment aggregators also require an RBI license with the payment aggregator license. They also need to be the Payment Card Industry Data Security Standard (PCI DSS) compliant.

Ownership

The Payment aggregators can be owned by private fintech companies. And the payment gateway can be owned by the public as well as the private banks, merchants, vendors, and payment aggregators.

How payment gateways and payment aggregators work together

It is a common misunderstanding that payment gateways alone are enough to process payments. This would work for a brick and mortar store (a POS machine for example) but not online. An online payment gateway is just the technological side of the transaction. It mostly takes care of the data in the payment messages.

Payment gateways have a bank working behind the scenes to issue merchant accounts. When there are too many merchants applying for merchant accounts, willing to process payments, the authorizing banks will have to organize both the underwriting and fund transfer process for multiple merchants, which could become too much.

This is where payment aggregators came in. Payment aggregators go through the underwriting process with the acquiring bank and process payments for many smaller sub-merchants.

You might be considering getting an online payment system for your business. Now as this article might have thrown some light, it might be easy for you to choose.

In the debate of Payment aggregator vs. payment gateway, you cannot choose one or the other. While you must have (the gateway), the other is a payment processing choice.