A Basic Introduction of Embedded Finance

Feb 24, 2022 - 5 MINS READ

Embedded Finance: A Basic Introduction

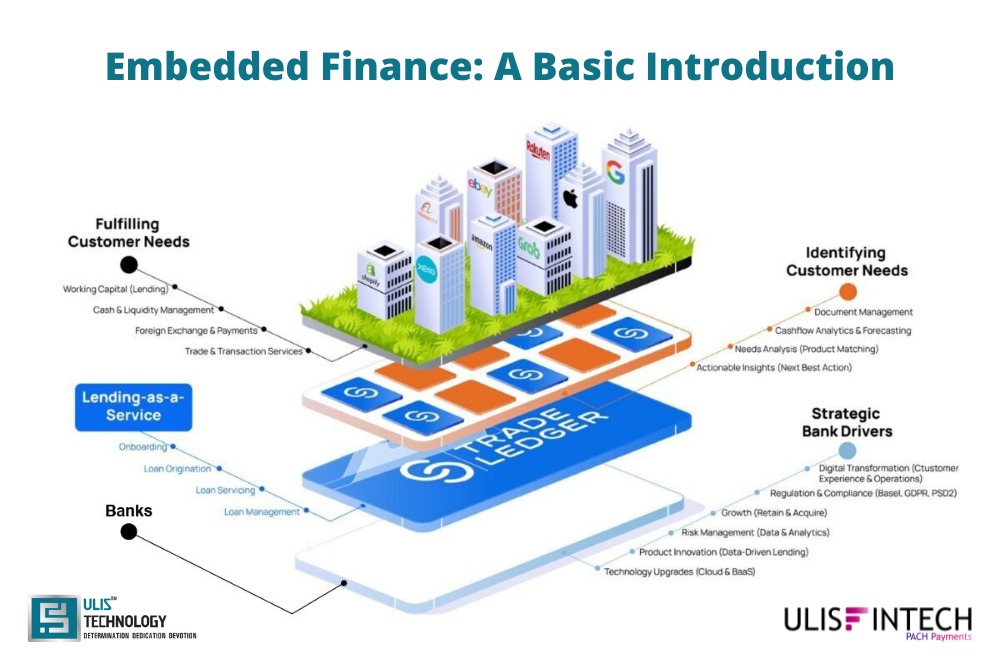

The smooth incorporation of financial services into typically non-financial businesses or products is known as embedded finance (also known as embedded banking).

Many impediments, such as financial sector rules, industry preparedness, and a lack of supporting technology, have given banks exclusive access to financial services and hindered non-financial businesses from doing so. However, recent industry pressure and regulatory changes (such as the open banking movement and PSD2) have helped to tear down barriers, allowing non-financial firms to interface with banks and other regulated institutions via APIs. As a result, businesses all around the world will be able to "embed" banking and financial services into their platforms.

Embedded Finance allows these companies to monetize their client base, boost customer lifetime value, and, most crucially, vertically grow their product offerings. It decreases the difficulties (costs, time, and so on) of developing a complete FinTech solution.

Understanding Embedded Finance Ecosystem's Major Players

The embedded finance ecosystem consists of three important stakeholders who make it feasible to supply financial solutions to users:

- Institutions of Finance

- Large banks, minor financing banks, and non-banking financial institutions are all included.

- They use their network to monitor and handle demands from the embedded financial ecosystem.

- They are in charge of regulatory, credit, and compliance issues.

- Platforms for Digital Content

- It consists of enterprises and non-fintech firms that own customer-facing digital platforms such as websites, mobile applications, and so on.

- They provide personalized financial solutions to their consumers through their platform.

- Companies that provide Embedded Finance Infrastructure

- FinTech firms comprise FinTech firms that create APIs to connect financial institutions to digital platforms (the other two key players).

- It provides services such as the loan lifecycle user experience, service quality, alternate data screening engines, and so on.

Embedded Finance Varieties

Because embedded finance has various advantages (which we shall discuss later in this article), an increasing number of firms are using it to provide a variety of financial services to their clients. Here are some elements of embedded finance:

- Payments Embedded

Through integrated payments, it is possible to make a smooth payment through a platform. Embedded payments are now a standard element of all e-commerce platforms and other programs that provide paid services to their clients, including purchases for computer games and payments for ordinary costs such as groceries, convenience stores, and coffee shops.

- Insurance That is Embedded

Why is integrated insurance becoming popular? Simply said, it gives today's customers more power. It simplifies the process of purchasing a typical insurance plan by combining it with a product or service at the point of sale.

- Embedded Credit

It is the seamless integration of "lending-as-a-feature" that allows digital platforms to offer credit services to their clients through a familiar interface. It may be used to get loans, repay them, and pay EMIs for things purchased online.

- Embedded Investments

Embedded investments simplify the investing process by offering a single platform to manage their investments. These platforms enable users to invest in mutual funds, retirement plans, the stock market, and other assets.

Embedded finance scenarios and solutions as various difficulties

- Offline Businesses –

Challenge: Businesses have struggled to satisfy customer demands in the decade after the Covid-19 outbreak in 2020. Organizations have been driven to innovate as a result of the unique circumstance, yet recruiting professionals and dealing with compliance concerns is incredibly challenging. Cost is a huge barrier for SMEs, and it stifles innovation.

Solution: Using banking-as-a-service solutions allows firms to simplify payments in a cost-effective manner.

- Healthcare –

Embedded Finance Difficulty: Healthcare bills are a major source of anxiety for many individuals. In addition, the absence of clear price and payment choices frequently impedes or delays treatment.

Solution: Embedded finance provides several prospects in the healthcare industry, ranging from improved health insurance coverage to providing better preventative medical services.

- Education financing -

Challenge: Since policies all around the world have made educational loans freely available to students. Sometimes students wind up taking out loans with higher interest rates, which has a negative impact on the borrower's financial health.

Solution: Using embedded finance platforms, the EdTech industry can perform in-depth research to assess a student's prospective ability to repay loans and lend accordingly.